- Get link

- Other Apps

- Get link

- Other Apps

The idea of money laundering is essential to be understood for those working in the financial sector. It is a process by which soiled cash is transformed into clean money. The sources of the cash in precise are legal and the money is invested in a approach that makes it seem like clear money and hide the identification of the criminal a part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new clients or maintaining existing clients the duty of adopting sufficient measures lie on each one who is part of the group. The identification of such component in the beginning is straightforward to take care of as a substitute realizing and encountering such conditions later on in the transaction stage. The central financial institution in any country offers complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such situations.

Although efforts on anti-money activities started at an early stage the solutions seem to be restricted to a strategic level. Credit card factoring also known as credit card laundering or even money laundering can exist in many forms.

Money Laundering Define Motive Methods Danger Magnitude Control

The clean legal money may come in the form of charitable organisations as well as legitimate businesses in order to disguise its intent and allow unthinkable actions to happen.

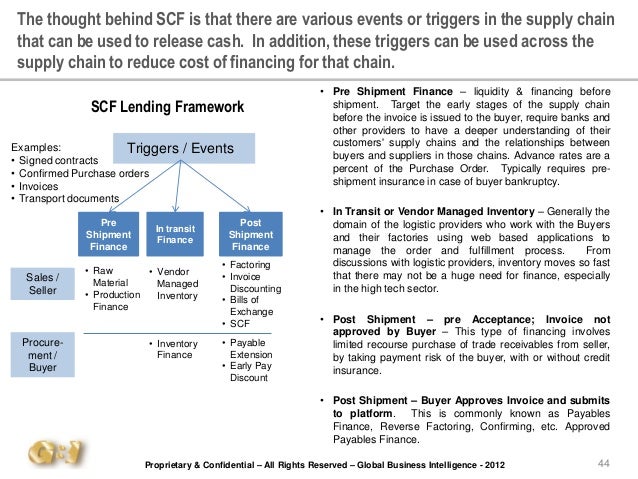

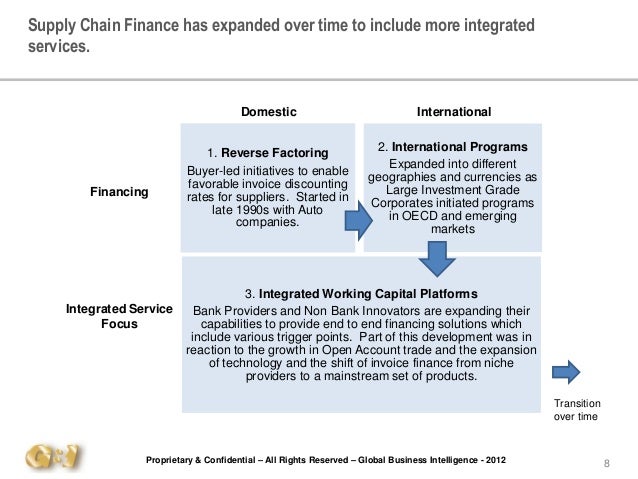

Reverse factoring money laundering. Trade Based Money Laundering TBML was recognized by the Financial Action Task Force FATF in its landmark 2006 study as one of the three main methods by which criminal organizations and terrorist financiers move money for the purpose of disguising its origins and integrating it back into the formal economy. The whole money laundering scheme worked as the hackers managed to circumvent checks recommended by Visa and MasterCard and succeed in exploiting. Terrorist financing is also often referred to as reverse money laundering as it focuses on utilising legal assets to carry out terrorist activities which are often in the form of clean sources such.

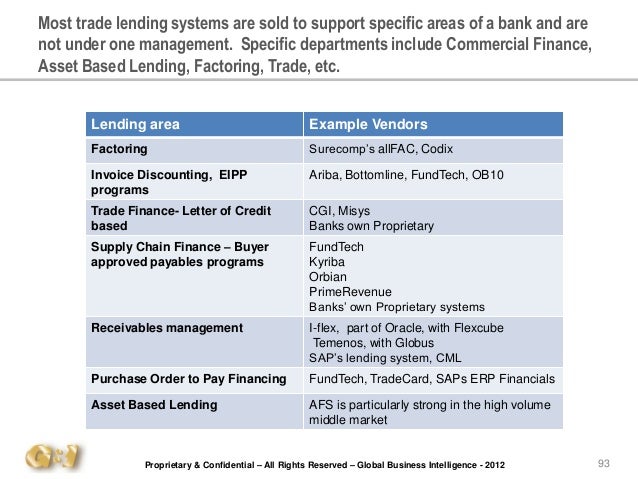

This method of money laundering. Therefore the money laundering risk analysis must also consider characteristics of the end customers that are decisive in the two-person constellation when determining the risk with regard to the customer. Discounting International Factoring Reverse Factoring and Asset Based Lending facilities.

It may seem strict but there are serious liability issues involved and once youve processed a charge on your merchant account you are legally liable to back up that charge and respond to any bank inquiries about potential chargebacks. Reverse money laundering is the process where the money that starts out legitimate and grows dirty in its ultimate purpose. Credit card factoring is essentially processing transactions through a merchant account for a business or entity other than the specific business that was screened for the merchant account.

Italys authorities are onto this but the new crime if indeed it is a crime is apparently on the increase in Italy and is providing investigators with growing headaches. Company and its subsidiaries collectively Paydek make every effort to remain in full compliance with all applicable anti-money laundering laws rules and standards in the jurisdictions in which it does business. Anti-money laundering is a procedure or method to find these laundering activities.

This includes your neighboring store whose credit card machine is down. Campbell 73 both of Rochester with charges related to money laundering and defrauding a significant number of companies involved in the American factoring. Ill ask Stefano for an update on the reverse money laundering thing the next.

Paydekfactoring is a company headquartered in United States. As required by law Paydekfactoring has designated a Chief Compliance Officer who leads a team of employees oversee Paydekfactorings anti-money laundering. This term is often used to describe a form of reverse money laundering because it works by using legal assets to carry out illegal activities.

Money laundering is a process of converting black money into white cash. In the risk analysis the factoring company must particularly take into account the money laundering risk resulting from the three-person constellation. In factoring the customer is generally regarded as the client of the factoring company.

Reverse money laundering is a process that disguises a legitimate source of funds that are to be used for illegal purposes. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. Anti-money laundering policy AML A policy put in place to help detect and report suspicious.

The most basic form of factoring would be a. The simplest way to avoid factoring is to refuse to process any credit cards for another companyat all. A federal grand jury in Rochester New York returned a 12-count indictment charging Kenneth M.

Griffin 45 and Brian K. It is usually perpetrated for the purpose of financing terrorism but can be also used by criminal organisations that have invested in legal businesses and would like to withdraw legitimate funds from official circulation. Because money laundering is a key part of terrorist organizations that are usually funded through illegal enterprises the FATF was also charged with directly fighting to cut off illegal cash flows to terrorists and terrorist groups.

Anti Money Laundering regulation in Europe requires that a risk based approach is taken in regard to Know Your Customer checks. There are many variations on each of these product sets and the precise nomenclature varies from market to. Hence systems designed to make clean money dirty or reverse money laundering.

However in a recent decision tha. Reverse Money Laundering. The results of this study indicate that in the reversal system of the burden of proof of criminal acts of money laundering each party has a burden of proof the public prosecutor is burdened to prove that these assets are the property of the defendant and has a relationship with the original criminal act charged while the defendant burdened to prove the origin of the assets claimed and if the.

Commercial Banking As A Key Factor For Smes Development In Mexico Through Factoring A Qualitative Approach Sciencedirect

Commercial Banking As A Key Factor For Smes Development In Mexico Through Factoring A Qualitative Approach Sciencedirect

Https Euf Eu Com Category 18 Public Html Download 358

Bizday Trusted Data Exchange For Corp And Supplier Onboarding Capge

Http Documents1 Worldbank Org Curated En 359771613563556978 Pdf Supply Chain Finance By Development Banks And Public Entities Handbook Pdf

Money Laundering Regulatory Risk Evaluation Using Bitmap Index Based Decision Tree Sciencedirect

Https Fci Nl Media 301 Download

Process Of Reverse Factoring Explained Balance Sheet Reverse Cash Flow

Overview Trade And Supply Chain Finance Program Asian Development Bank

Https Iccwbo Org Content Uploads Sites 3 2016 11 Scf Techniques Draft Version 03112015 Pdf

The world of regulations can appear to be a bowl of alphabet soup at instances. US cash laundering laws aren't any exception. We now have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting agency focused on protecting financial services by reducing threat, fraud and losses. We now have massive financial institution expertise in operational and regulatory risk. We now have a robust background in program management, regulatory and operational threat as well as Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many opposed consequences to the group because of the dangers it presents. It increases the chance of major risks and the opportunity value of the bank and ultimately causes the bank to face losses.

Comments

Post a Comment