- Get link

- Other Apps

- Get link

- Other Apps

The idea of money laundering is essential to be understood for these working in the monetary sector. It's a process by which soiled cash is transformed into clean cash. The sources of the cash in actual are prison and the money is invested in a way that makes it look like clear money and hide the id of the felony part of the money earned.

Whereas executing the financial transactions and establishing relationship with the new clients or maintaining present prospects the obligation of adopting enough measures lie on each one who is a part of the group. The identification of such ingredient in the beginning is simple to take care of as a substitute realizing and encountering such situations afterward in the transaction stage. The central financial institution in any country gives complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to discourage such situations.

Even more importantly it demonstrates to regulators that the employers are committed to combating money laundering. Before they buy an airline ticket or spend money on terrorist activities the money has to be funneled into accounts that look legitimate.

Global Anti Money Laundering Aml Software Market 2020 Segmentation Demand Growth Trend Opportunity And For Money Laundering Segmentation Marketing Trends

Criminals transform proceeds into assets such as houses or businesses or other seemingly legitimate funds for example money in a bank account.

How anti money laundering works. What is AMLBot and how does it work. The CAMS certification keeps anti-money laundering specialists aware of new industry trends. This is the point when the criminal wants to cut off the links between the crime and the money.

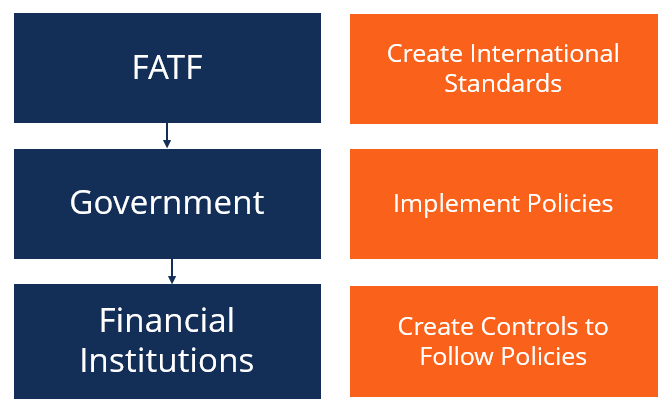

This is done by monitoring transactions customers and entire networks of behaviors. This method typically works in one of two ways. The FATF was responsible for the creation of most anti-money laundering standards and it made a framework for countries to follow.

Launderers do this by moving the funds around more often than not between countries. In some cases laundered money is used to fund terrorism. And the practice is about as old as money itself.

But how does it actually work. Or the launderer can simply hide his dirty money in the companys legitimate bank accounts in the hopes that authorities wont compare the bank balance to. They are key personnel within a business to ensure all AML requirements are strictly followed and to prevent businesses companies entities or institutions from being subject to regulatory compliance issues from governing bodies.

This works by layering financial transactions to obscure the trail that the authorities could follow to find the origin of the money. An anti-money laundering AML analyst or officer basically investigates monitors and manages suspicious financial activity. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits.

Money laundering is when criminals clean the proceeds the financial gains of crime. Anti-money laundering laws entered the global arena soon after the Financial Action Task Force was created. Dirty money is just money that has entered the banking system through back doors and anti-money laundering or anti-money-laundering is just a political effort to convince all banks to close their back doors.

Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Spann describes the ins and outs of. Anti-money laundering largely is a quantitative study of money transfers and a sort of auditing function.

A successful anti-money laundering program involves using data and analytics to detect unusual activities. Whats dirty money or anti-money laundering. Placement techniques include structuring currency deposits in amounts below the 10000 reporting requirement for banks or commingling the illicit funds with money from legal activities.

Money laundering is the term for any process that cleans illegally obtained funds of their dirty criminal origins allowing them to be used within the legal economy. We also clarify Countering Financing of Terro. As artificial intelligence technologies like machine learning become more prevalent these next-gen AML technologies will automate many manual processes helping to effectively identify financial crimes risks.

In this video we explain money laundering why it is important to stop and prevent it and how we achieve this. By pursuing this credential financial auditors prove they are committed to their craft and the development of their professional skills. Our anti-money laundering work.

Anti-money laundering programs can help to combat terrorism. One need not be an accountant and can be trained to understand the many ways money can be laundered and how to examine money movements. AMLBot is an anti-money laundering AML robot that can check crypto wallets for illicit funds.

The launderer can combine his dirty money with the companys clean revenues in this case the company reports higher revenues from its legitimate business than its really earning. Terrorists may receive money from legal or illicit sources.

Layering Aml Anti Money Laundering

Casino Govt Regulations Include Safeguards Designed To Prevent Money Laundering By Junkets Infographic Money Laundering Prevention Infographic

How Money Laundering Works Money Laundering How To Get Money Finance Investing

Watch Vinodji Explain The Concept Of Know Your Customer Kyc And Anti Money Laundering Aml In This Video Series Which Is Part Of A Customer Education Initia

Anti Money Laundering Overview Process And History

Become A Certified Anti Money Laundering Specialist Today Risk Management Risk Advisory University Of Ghana

Pin On Ommor Work With Everything

Anti Money Laundering Overview Process And History

What Is Anti Money Laundering Aml Money Laundering Financial Literacy Money

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Business Advice

1 Anti Money Laundering Framework Download Scientific Diagram

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

The world of regulations can seem like a bowl of alphabet soup at occasions. US money laundering regulations aren't any exception. We now have compiled a listing of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending monetary providers by reducing threat, fraud and losses. We've massive bank expertise in operational and regulatory risk. We have a strong background in program management, regulatory and operational danger as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many hostile penalties to the organization due to the dangers it presents. It will increase the likelihood of major risks and the opportunity value of the financial institution and finally causes the financial institution to face losses.

Comments

Post a Comment